The Debt Offensive: Focusing on Austerity

The United States’ national deficit exceeds $13 trillion—over $42,000 per US resident. With U.S. gross domestic product (GDP) at $14 trillion in 2009, our debt-to-GDP ratio is 93 percent and growing. Japan enjoyed 90 percent debt-to-GDP levels in 1995. Following two decades of stagnant growth, Japan now risks exceeding 190 percent. 15 years from now, America’s Debt-to-GDP ratio may double as well. While debt-to-GDP ratios are important to consider, a country’s debt-service-ratio (DSR) may more accurately assess sovereign debt risk. This index shows how much government revenue must be allocated to annual interest payments by dividing annual interest payments due on sovereign debt by annual tax revenue. Interest due on American debt was $383 billion in 2009 while tax revenue was $2,211 billion. At 17 percent, America’s DSR is actually higher than Japan’s (16.5 percent). Current interest rates can only increase, and dictate an accompanying increase in the American DSR.

A private company, if solvent, would never be unwilling to repay debt. However, sovereign nations, such as Greece most recently, have proved quite unwilling. With 20 percent more debt than GDP in 2009, Greece faced an unsustainable deficit. The value of its government bonds, even with additional insurance on them, was less than any other sovereign-issued bond. In terms of price, investor confidence in Greece’s willingness to repay debt eroded. Loan supplies dwindled, forcing Greece to pay more per loan and further exacerbating its debt woes. And as investors fearfully fled Greek bonds, Greece had even less credit to finance its debt. As the Greek debt crisis spiraled out of control in 2010 and necessitated a bailout, it proved every fleeing investor right. This has reprecussions on the global bond markets where investor skepticism about holding sovereign debt reached peak levels. It resembles the “flash crash” earlier this year. The Dow Jones Industrial Average plummeted 9 percent in minutes, the second largest one-day point loss, thanks to the impetus of a single mutual fund that feared U.S. exposure to European debt.

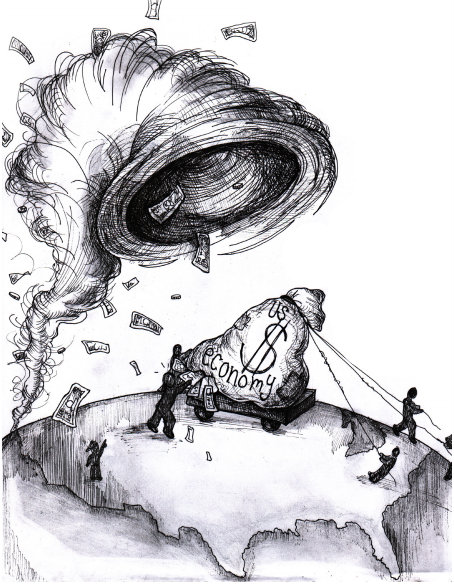

Over the next two decades, U.S. debt holders risk substantial capital losses as significant changes in the demographic landscape occur. Most notably, the baby boomer generation will begin retiring en masse within 15 years (as they have already started in Japan), bringing the retiree to taxpayer ratio to a blatantly unsustainable 3 to 1. With too few paying in and too many cashing out, government entitlement programs like Social Security will overheat. Naturally then, the supply of investable funds will decrease against relatively stable investment demand, and the price of investment (the interest rate) will increase. For investors locked into current interest rates, rising interest rates mean losses equal to or greater than the current yield. Faced with such losses, these investors will abandon American debt. Because of increasing securitization and financial integration, we are all tied to this debt in one way or another. If something doesn’t change, we all stand to lose.

Unlike Greece, which depends on Germany’s Bundesbank via its European Union relationship, the United States has the Federal Reserve with which to service debt. With the Treasury’s printing presses, the Federal Reserve can easily print fresh cash to repay debtors and keep interest rates low, at least in the near term. However, as the supply of cash increases, the interest rate decreases. Since 2008, the Fed has furiously printed cash to keep interest rates and unemployment low. Although official numbers indicate deflation since the recession’s onset in 2008, cash printing and the rising price of gold (which increased 30 percent in 2010 alone) are leading indicators of inflation. This imminent inflation looks threatening to lenders since, with their initial loan returned amidst price inflation, they lose purchasing power. Understandably, lending to a government likely to inflate its currency is unappealing. While seignorage (to print fresh cash to pay off debts) income has not been a significant problem in American economic history, the US government can and will inflate the dollar to repay debt and keep interest rates low. Investors know this.

The Fed’s money printing will help neither the U.S., nor investors. With interest rates near zero, borrowing can become only marginally cheaper. GDP growth stagnates below 2 percent, unemployment remains high near 10 percent, and debt exceeds the 90 percent debt-to-GDP level. Chairman Ben Bernanke has alluded to the Fed’s loss of policy options, short of immense debt purchases, to stimulate bank lending and employment. He advocates further fiscal efforts to aid the recovery, but warns that the deficit must be controlled. Our already massive fiscal expansion has failed. The government doled out $362 billion alone in 2009 to fund the Recovery Act, yet the economy grew by only $250 billion. According to the Congressional Budget Office and Moody’s Rating Agency, these efforts have saved or created at most 5 million American jobs through 2009, working out to at least $72,000 per job. But since the average private sector salary was 45 percent less at $40,000, this government spending seems uneconomical.

Early 20th century British economist John Maynard Keynes argued that each dollar of government stimulus spending would increase national income by over one dollar, since every government dollar is continually re-spent. However, having gained less than 70 cents per government dollar spent in 2009, this clearly has not worked. Any benefit to national income from government spending has been dampened by the following four factors. Government consumption has taken resources that might otherwise have been consumed by private enterprise, and increased government borrowing to fund this consumption has crowded out private investment. The flood of government purchases initially increased income and, in turn increased imports while decreasing exports for a net loss. Additionally, the multiplier’s compounding consumption effect has been mitigated as American, repay personal debts, with the savings rate climbing to 6 percent in 2008. Finally, an implicit drag on government expenditure effectiveness is the government’s Department of Motor Vehicles-esque inefficient allocation of resources. America’s abysmal 1 to 3 percent post-recessionary growth is not perplexing.

What does this mean for the national debt? There are two counter-trends when it comes to the current situation with our national debt. Households and firms have realized how important savings are. Balance sheets must be repaired. Debts must be repaid. On the corporate and national scale, this means replenishment of capital inventory—trucks, roads, computer systems, etc., all vital factors of production and growth. Capital reinvestment, however, requires an adequate level of savings. U.S. households and firms recognize this and are reacting accordingly, but the government has missed the memo. Beginning with the Bush administration and increasingly with Obama’s, politicians have continued rampant spending and borrowing practices despite massive deficits and inefficient stimulus policy. By popular vote we have essentially condoned such fiscal irresponsibility, naively expecting that someone in the future will repay that debt. After all, as Keynes said, we’re all dead in the long run.

What does this mean for the national debt? There are two counter-trends when it comes to the current situation with our national debt. Households and firms have realized how important savings are. Balance sheets must be repaired. Debts must be repaid. On the corporate and national scale, this means replenishment of capital inventory—trucks, roads, computer systems, etc., all vital factors of production and growth. Capital reinvestment, however, requires an adequate level of savings. U.S. households and firms recognize this and are reacting accordingly, but the government has missed the memo. Beginning with the Bush administration and increasingly with Obama’s, politicians have continued rampant spending and borrowing practices despite massive deficits and inefficient stimulus policy. By popular vote we have essentially condoned such fiscal irresponsibility, naively expecting that someone in the future will repay that debt. After all, as Keynes said, we’re all dead in the long run.

That future someone—the Millenials, as the rising generation is called—would be unwise to adopt Keynes’s and the baby boomers’ world-view. Within two decades, retiring baby boomers will easily deplete our Social Security coffers, drive the U.S. deficit deeper, increase interest rates, and cause investors to flee U.S. debt. Without the necessary policy changes, the American debt-service ratio and capability to finance debt will deteriorate. And unlike Greece, a small country under the auspices of the European Union and International Monetary Fund (IMF), there is no entity capable of bailing out the American economic hegemon.

The United States would face two options. Most likely, the U.S. would print fresh cash to pay its debts, thereby massively devaluing the dollar and causing rampant inflation. As a result, investors would essentially be cheated out of their initial investment in U.S. bonds: the Chinese, by far our largest lender, would have paid a dollar, only to receive a paper clip. Transitioning away from American imports and towards developing markets in Brazil and India, it is unlikely the Chinese would lend again at an affordable rate. The second option, defaulting and refusing to repay debt completely, could have worse ramifications. America would lose all credibility. Our cost of borrowing would skyrocket, if borrowing were still possible at all. Just look at Russia, which defaulted on its debt in 1998. It took 10 years of economic exile before the Russian government could borrow again.

This debt spiral could even turn global. Were the U.S. to massively devalue the dollar, other grossly indebted governments could retaliate with “beggar-thy-neighbor” policies, desperately devaluing their currencies to repair trade balances. In this global hyperinflationary environment, the basis for all sovereign debt and international trade would collapse.

Something must change now. The Federal Reserve has lost its strong ability to influence the economy through monetary policy since the recent financial crisis. Meanwhile, growing hordes of dormant cash in bank vaults suggests that the U.S. risks rampant inflation. Compounding the problem, current government spending has been ineffective if not harmful. Enhanced tax cuts and a leaner government, however, stand ready as powerful tools to succeed in each of the four ways that government expenditures have failed. With government out of the way, private firms would have more funds to allocate towards productive investment and amidst lower transaction taxes, more freedom to do so. Thanks to the Bush and Obama cuts, business activity has increased through fiscal year 2010 as companies earn profits under nurturing tax conditions, but business activity will slow if tax cuts expire as planned in 2011. In addition, spending by firms and individuals would go towards products people really need, rather than more DMV pamphlets. As with the government multiplier, increasing incomes would initially decrease our net exports. However, productive investment and consumption by American firms and individuals would lead to more internationally competitive American products, more efficient production, more internationally competitive prices, and eventually raise our net export balance. The fraction consumed from tax cuts would be spent more efficiently in every way.

Much like a government stimulus, a fraction of each dollar from tax cuts would be saved. Oddly, economists often criticize the savings rate as a hindrance to growth because money is not spent immediately. However, increased savings rates combined with increased private income means more funds will be saved and reinvested to restore a depreciating capital stock. In the long run (really only a matter of years) investment into new capital and productivity is what drives and sustains economic growth, creates jobs, and allows for nations to deal effectively with debt. The supposedly miraculous growth experienced by Hong Kong, South Korea, Singapore and Taiwan between 1960 and 1990 is attributed unanimously to unparalleled rates of savings and productive investment.

Recent Bush and Obama tax cuts have been progressive and have detracted from potential investment. Taxpayers who save and reinvest in American capital are increasingly those from higher tax brackets. Between 30 and 50 percent of the working American population pays absolutely no tax at all, and many receive government handouts. Tax revenue declined over $420 billion between fiscal years 2008 and 2009. With taxpayers decreasingly wealthy and increasingly scarce, $320 billion (76 percent) of that decline has been attributed solely to recessionary income loss. Tax revenue will decline further, along with savings and investment, so long as the top 1 percent of earners, paying 37 percent of total revenue, is continually ground down by taxes and economic stagnation. Besides the threat to essential savings and investment, progressive taxes sow moral hazard. When taxpayers realize half of their hard-earned income will be taxed away—indeed, they could be paid for doing nothing—their incentive to work is understandably jeopardized.

This is not to suggest that we completely abolish progressive taxation, but rather, along with decreasing government entitlement programs, implement three tax policy changes. Widen our nation’s tax base. Rather than subsist on government handouts, the new lower tax brackets would benefit more from gainful employment (even with taxes) and would necessarily be encouraged to work harder, as would every tax bracket. Distribute taxes (by percentage of income) more evenly around the base. Lower taxes across the board indefinitely. These three policy changes will simplify the tax code, widen the collection base, increase tax revenue, and reduce the risk of recessionary-based revenue loss while encouraging those in higher tax brackets to replenish depreciating capital. Furthermore, these policy changes will provide an effective and demographically unprejudiced fiscal stimulus, free up business transactions, and further encourage worker productivity. A leaner, more efficient government with revised social welfare systems and support from a larger tax base will serve to decrease the deficit and rejuvenate faith in American sovereign debt. By acknowledging the dangers of our social safety nets and unsustainable profligacy, we may find significantly reduced risk and sustainable growth. Our generation will learn to work harder and more efficiently. We can become more responsible and self-sufficient. Millenials have the opportunity to rebuild a nation, restore market confidence, and recreate the world. Perhaps good may come of this recession yet.